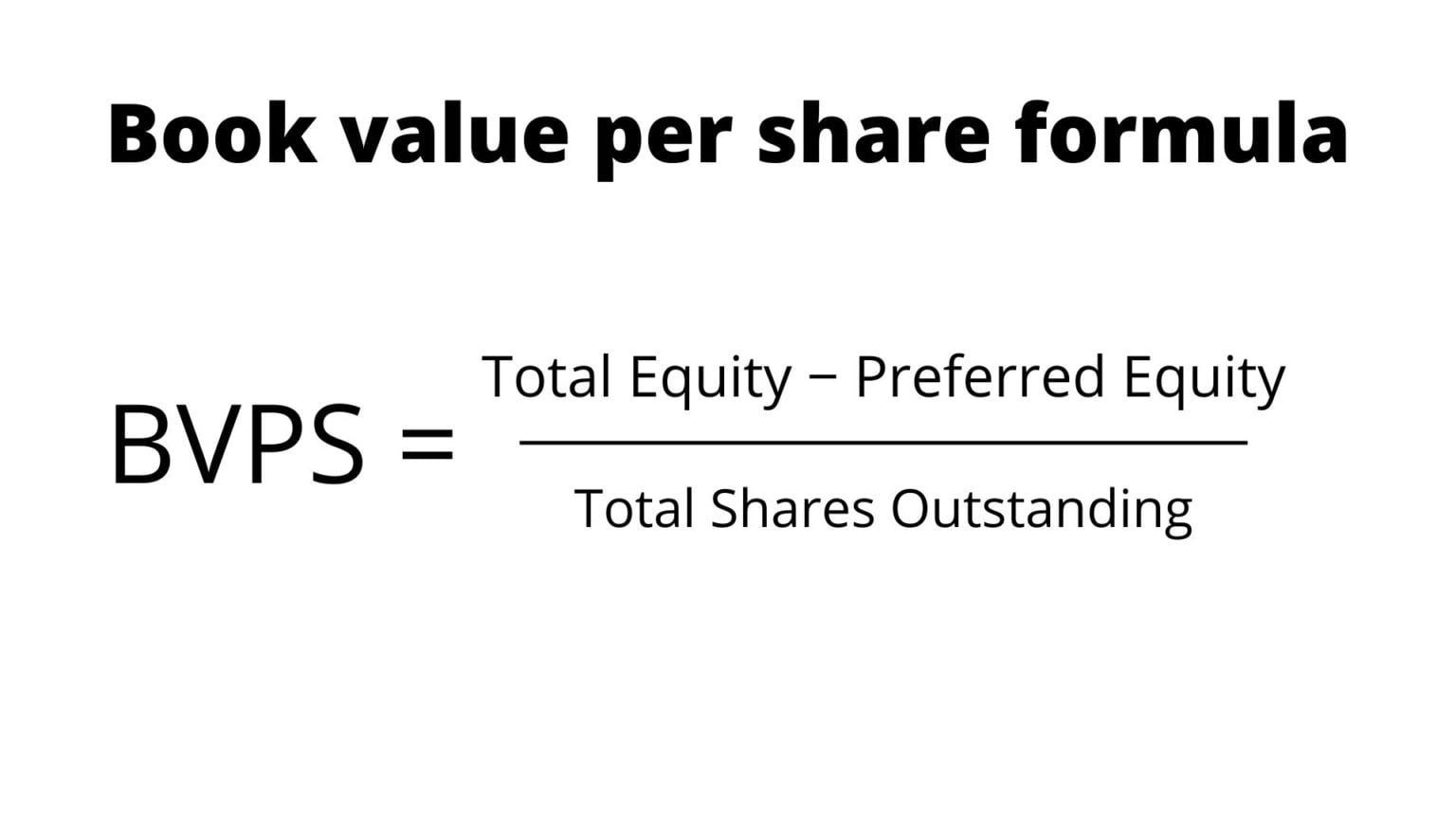

Book Value Per Common Share BVPS: Definition and Calculation

The shareholders equity ratio, or “equity ratio”, is a method to ensure the amount of leverage used to fund the operations of a company is reasonable. From the viewpoint of shareholders, treasury stock is a discretionary decision made by management to indirectly compensate equity holders. Under a hypothetical liquidation scenario in which all liabilities are cleared off its books, the residual value that remains reflects the concept of shareholders equity. Shareholders’ equity is the residual claims on the company’s assets belonging to the company’s owners once all liabilities have been paid down. Please enter as a percentage without the percent sign (for 10%, enter 10). If you need to calculate the growth rate, tap/click the link on this line to open the stock growth rate calculator in a new window.

Fixed Income Outlook: Bonds Hit Reset. A New Equilibrium Emerges

This free online Stock Price Calculator will calculate the most you could pay for a stock and still earn your required rate of return. Looking at the same period one year earlier, we can see that the year-over-year (YOY) change in equity was an increase of $9.5 billion. The balance sheet shows this increase is due to a decrease in liabilities larger than the decrease in assets. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

How do you find the common stock on a balance sheet?

- If stocks perform well, their price go up and investors earn huge profit.

- Common stock can be more sensitive to market fluctuations compared to preferred stock.

- You can see the frequency and probability of the demand rate that you can calculate in the same way as in lead time.

- In recent years, more companies have been increasingly inclined to participate in share buyback programs, rather than issuing dividends.

- It shows how much money was raised from selling shares to investors, often referred to as the common stock balance.

Preferred stock is a distinct class of stock that provides different rights compared with common stock. While both types confer ownership in a company, preferred stockholders have a higher claim to the company's assets and dividends than common stockholders. 1.Common Stocks– An investor can purchase both types of stocks when available as both have their own privileges. When people purchase common stocks, it means they have voting right in the important decisions and other events in the company. They also get dividends when issued by the company but do not have a preference to get it. The issuance of common stock cannot be more than the authorized number but can give less than the number of authorized shares.

Why Do Companies Issue Preferred Stock?

As of mid-2024, the Nasadaq had some 3,377 listings but the NYSE the largest in the world by market cap. Smaller companies that can't meet the listing requirements of these major exchanges are considered unlisted and their stocks are traded over the counter. In contrast, if it is negative, it means the accounting organizational structure business has a short life span or cannot survive in the long term. For the survival of a business, assets should be more than liabilities. Such real-life instances illustrate the application of valuation methods, underscoring the importance of company-specific factors in determining stock values.

Common stock, as its name implies, is one of the most ordinary types of stock. It gives shareholders a stake in the underlying business, as well as voting rights to elect a board of directors and a claim to a portion of the company's assets and future revenues. However, common stockholders have a lower position than preferred stockholders, who get priority on dividend payments and in recovering their investment if the company is liquidated. Selling preferred stock, like any other shares, lets a company raise money by selling a stake in the business.

In most cases, retained earnings are the largest component of stockholders' equity. This is especially true when dealing with companies that have been in business for many years. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. Common stock repurchases can push up a company’s stock price in the short term. But the question of whether they’re good for companies in the long term is more complicated. Stock buybacks don’t actually change anything about the company’s operations or financial results.

Safety stock is a buffer that absorbs the demand and supply variability so your business can keep running smoothly. If you have safety stock, you ensure your production lines keep running, your shelves stay stocked, and your services are uninterrupted. This post will cover some tips and calculations for determining the right amount of safety stock and formulas and methods to minimize inventory costs and avoid stockouts. For instance, consider a company's brand value, which is built through a series of marketing campaigns. U.S. generally accepted accounting principles (GAAP) require marketing costs to be expensed immediately, reducing the book value per share. However, if advertising efforts enhance the image of a company's products, the company can charge premium prices and create brand value.

Common stock is a way for investors to get dividends, or rewards, and possibly own more valuable slices if the company does well. Preferred stock is another type of share, offering certain benefits like getting dividends first. Shareholders aim for the pie (company) to grow, making their shares more valuable. A healthy balance sheet is crucial for ensuring the company's success and rewarding its investors. The shareholders equity ratio measures the proportion of a company’s total equity to its total assets on its balance sheet.

If there is a little supply chain failure on the supply side of the chain, you will have problems satisfying the demand fluctuations. This calculation ensures that you have enough buffer stock to meet average demand. Our above calculation says that the results with this formula are something that will definitely bring stock out. With these formulas, you can ensure that your inventory levels are neither too high, leading to increased holding costs, nor too low, resulting in potential stockouts and lost sales.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/EURFMOSBYBFXRANTOU67KVTT4I.jpg&h=300&w=450&zc=1)

Book Value Per Common Share BVPS: Definition and Calculation:等您坐沙发呢!